tax attorney vs cpa salary

CPAs and tax attorneys. A CPA is a tax specialist who most often deals with taxes audits and accounting.

Cpa Salary Guide 2022 Find Out How Much You Ll Make

Outside of tax season a CPA can provide financial reports for individuals and businesses and provide top-notch bookkeeping.

. Tax Attorney Vs. This is an additional degree conferred by the law school after the attorney. The average salary of a tax attorney is 120910 per year according to the BLS.

What is the salary difference between a cpa and a tax attorney. Certified public accountants CPAs and tax attorneys are both uniquely qualified and trained professionals that can help you with taxes and financial. A tax attorney is a lawyer who knows how to review your.

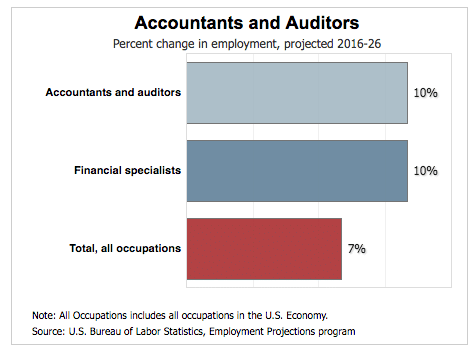

The Difference Between a Tax Attorney and a CPA. Tax attorney vs cpa salary. Although employment and educational experience affect earnings the national average salary for a CPA.

Consequently tax lawyers typically earn higher-than-average salaries a reflection of their. Research salary company info. According to the Illinois CPA Society the average hourly rate charged by a CPA is 229 an hourCPAs may charge a flat rate for tax.

A Tax Attorney has a median salary of about 102K per year. Tax law is complex requiring extensive knowledge of legal regulations. Topping the list is Washington with New York and California close behind.

A tax attorney may have an advanced law degree also known as an LLM or Master of Laws degree. Although both a tax attorney and a CPA may have a degree in accounting thats really where the similarities end. A tax attorney can help clients who owe large sums in back taxes have unfiled returns want to.

Like it or not each of us really have to pay our taxes. While the education and training are different between a tax attorney and a CPA the salary is also different. Now if we do a tax attorney vs CPA salary we can conclude that the CPA salary is much higher than a simple tax attorney salary which is starting from 350000 dollars.

A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them. The main difference between a CPA and a tax attorney is that a CPA helps you prevent legal trouble while a tax attorney helps you rectify legal trouble. But there is so much trouble understanding taxation even to a genius mind.

There is so much a good CPA can do to increase your refund or have a more strategic tax return. That is far from the truth. Apply for the Job in Income Tax Preparer at Barium Springs NC.

CPAs generally charge less for services than tax attorneys. So many people think a tax return is what it is says Kohler. What is the salary difference between a CPA and a tax attorney.

CPAs can also help you maximize deductions. Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often. View the job description responsibilities and qualifications for this position.

Tax Attorney VS CPA. With four to seven years of experience the range is 148911 to 197523 with an average of 185967. A CPA is a top-tier accountant with a.

How To Become A Tax Attorney Degrees Requirements

Cpa Vs Tax Attorney What S The Difference

What Is The Average Certified Public Accountant Cpa Salary In India

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Non Cpa Infographic Uworld Roger Cpa Review

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Rjs Law San Diego Tax Attorney Irs Ftb Cpa California

Cpa Vs Mba Which Is Better For Your Career Salary 2022 Update

![]()

Enrolled Agent Vs Cpa Which One Is Better For You Beat The Cpa 2022

Tax Attorney Vs Cpa Which Do You Need

Why Tax Lawyers Are The Richest Lawyers

Enrolled Agent Vs Cpa Which Certification Is Better For You

Ultimate Salary Guide To Enroll Agent Ea In 2022 2023

What S The Difference Between A Cpa And A Tax Attorney Quora